TechFin, The global economy of finance and banking has been experiencing a new level of development over the past several decades. And the modifications are in no way indicative of a halt. Leaving the financial sector little time to pause and respond.

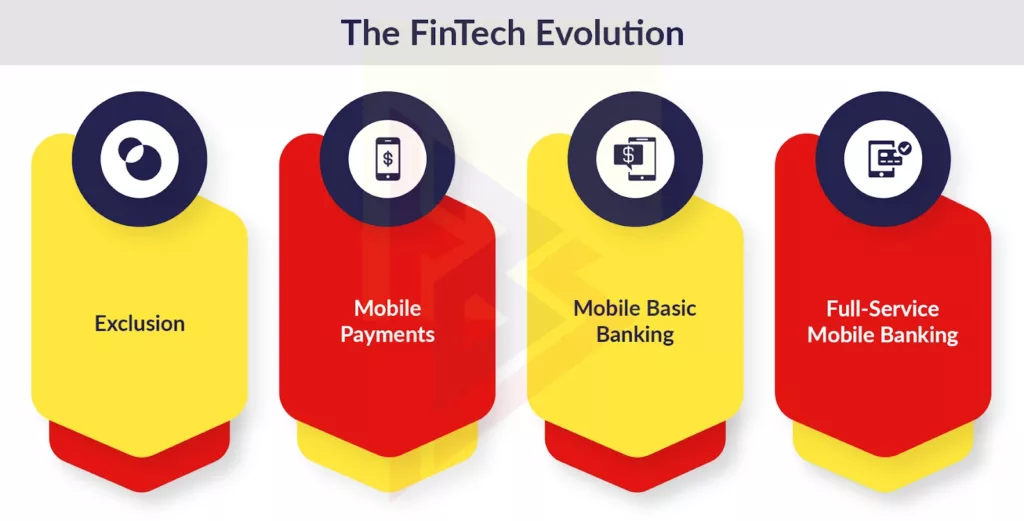

First from a traditional banking system to digital, then from fiat money to digital currency. And now when the Finance world was still becoming accustomed to all this modernism, a new trend joined the field, introducing itself as the future finance and banking environment.

TechFin is the current trend in banking technology that will soon enter the global market. However, what is TechFin? And what effect would this have? TechFin is the current trend in banking technology that will soon enter the global market. However, what is TechFin? And what effect would this have?

While closely approaching the FinTech notion, that we have seen and been, accustomed to, the concept itself is, fundamentally different. Something that is currently gradually creating an increase in search engine searches and questions received by financial software development firms: FinTech versus TechFin: Is there a distinction? And if there is, where do TechFin and FinTech fit into the future of Finance and Banking?

Let us attempt to answer both questions in this article.

The development of modern financial software began around ten years ago amid the global financial crisis. Which persuaded incumbents to struggle for survival. This allowed a great deal of leeway for inventors to develop enterprises. And it was, around this time that Square was, founded, a defining moment.

And as the economy became more stable. So grew the influence of players who entered the market with the aid of financial application development businesses to take banking activity away from banks. Since Square and PayPal, the advances in the finance business have continued unabated. One after another, new offers entered the market, each promising to raise the bar for user experience.

And the momentum that began at that time has now reached a point that was unimaginable years ago: the point where technology and money converge.

TechFin, also known as the movement. It will bring about a momentous revolution not only in the use of financial institutions. But also in the rationale for their very existence.

Before we move on to the phases of how FinTech came to exist. Where FinTech is, headed in the future – TechFin, let me answer the obvious question: what is the difference between FinTech and TechFin?

Read about the Best ASP.NET Tools To Build Mind-blowing Web Applications, here in our blog.

The Three Phases Of IT-Enabled Business Transformation

During the 1960s and 1970s, the first wave of IT-enabled corporate transformation mechanized individual tasks, resulting in greater productivity and efficiency. Software-enabled operations automation led to the acquisition and analysis of fresh data in each action, resulting in the standardization of procedures.

In the 1990s, the second wave of IT-enabled corporate transformation occurred due to the internet’s cheap and pervasive connectivity, facilitating information access. Internet applications disrupted the traditional corporate value chain by lowering entry barriers and generating new substitutes, thereby increasing market competition.

In the third phase of IT-enabled company transformation, information technology becomes an inherent component of the product, erasing industry boundaries.

Banking and financial services have always been information-intensive, with high-information-content core products and operations. They were the first in their industry to utilize information technology to acquire a competitive advantage. Towards the end of the 1970s, the first generation of banking and financial services transformation implemented core banking solutions. That was, mostly built in-house and offered a few fundamental functionalities, such as client data management, transactions, record-keeping, etc.

In the second wave of the transformation of banking and financial services, internet-enabled institutions give customers an online means to access banking services. It also resulted in the emergence of new competitors, usually known as Fintech. Which were, essentially internet-powered platforms that harnessed technological innovation and data power to disrupt particular financial services business sectors.

The third generation of banking and financial services transformation is, defined by the embedding of financial services such as payments and lending within the core products of non-financial enterprises to increase the attractiveness of the core offers. TechFin refers to these non-finance enterprises. These are primarily internet corporations from varied industries, including e-commerce, telecommunications, search engines, social media platforms, gaming companies, etc.

The financial services industry will continue to be, disrupted by Fintech and TechFin. We examine the distinction between FIntech and TechFin. And it determines how each will impact the future of finance and the economy.

Read why Golang is the best language for AI?

What is Fintech?

The fundamental business of fintech companies is financial services. Even though the term is typically applied to technology startups that disrupt banks and financial services.

A fintech company takes a targeted approach by finding gaps or inefficiencies in existing processes and implementing emerging technologies to address the issue. Fintech uses API (Application Programming Interface), Artificial Intelligence (AI) and machine learning (ML), and Blockchain to develop novel solutions in diverse fields of financial services, including payments, lending, money transfers, investment advisory, and open banking. FinTech development will steer business model innovation in the banking and financial services sector as a whole.

Fintechs can generally be categorized as follows:

- Accounting & Finance

- Business Lending & Finance

- Asset Management

- Core Banking & Infrastructure

- Capital Markets

- Financial Services & Automation

- Mobile Wallets & Remittances

- Credit Score & Analytics

- Crypto

- Payments Processing & Networks

- General Lending & Marketplaces

- Insurance

- Real Estate & Mortgage

- POS & Consumer Lending

- Payroll & Benefits

- Personal Finance

- Retail Investing & Secondary Markets

- Regulatory & Compliance

Neobanks, another type of Fintech, are online-only or digital banks with no physical locations. They offer individualized services to clients while cutting operational expenses by integrating technology and artificial intelligence. Despite the speed with which Neobanks have gained consumers. Their impact on the financial services industry has yet to be determined.

Even incumbent financial institutions utilize evolving technologies to provide customers with differentiated products and enhanced services. Still, they are constrained by historical constraints that do not afford them the same flexibility as Fintech. Online and mobile banking are the most prevalent Fintech technologies adopted by incumbent financial services firms.

What is TechFin?

TechFin consists of technology businesses whose major business does not finance. But who includes financial services in their core products to make them more appealing? These firms intend to disrupt the banking and financial services industry by leveraging their current customer connection and behavioral data. Access to client information is the most important advantage of these businesses.

TechFin is initially focused on the distribution side of the financial services industry. But it is content for banks to manage regulatory compliance obligations. They are interested in acquiring access to clients’ financial transaction data. Which diversifies their existing customer data and provides them with a true financial portrait of their customers.

Each technology company has unique consumer information. Social media firms collect information on the social interests and activities of their users. Whereas e-commerce companies collect information on client demand, transactions, and payment history. Google has data on nearly every area of customer life, whereas Apple and other telecommunications firms have data on user behavior, location, and activities. TechFin firms are interested in augmenting existing client data with transactional information in order to enhance their main product and provide supplementary financial services.

TechFin’s platform-centric, data-driven business models are independent of the financial services margin. Therefore, banks and financial services firms face bigger obstacles than Fintech.

Fintech Vs. TechFin: Key Differences

Unlike Fintech, TechFin leverages captive customer data

When building solutions, Fintech companies do not have a captive consumer base, data, or brand loyalty. TechFin, on the other hand, begins with a dedicated customer base and a tremendous amount of data previously acquired.

The Difference in key business objectives

In the framework of Fintech and Techfin’s key business objectives is another area of differentiation. FinTech’s primary business purpose is to improve the customer experience through the use of digital technologies that minimize customer friction and expense while providing extra features and benefits. The fundamental business of Fintech is financial services, and its viability depends on margins.

TechFin’s primary business purpose is to expand into a complementary financial services industry to complement its main products and services. In contrast to Fintech, these companies do not only provide financial services; hence, their profitability is not dependent on margins.

In contrast to Fintech, TechFin is well-positioned to collaborate with mainstream banks and financial institutions.

TechFin, with its loyal customer base and data, is in a better position than Fintech to challenge traditional banks and financial institutions. This is not lost on the incumbent financial services firms partnering with internet titans, even if it means sharing important data and distribution income. Typically, TechFin begins with payment solutions and then adds supplementary products and services to earn more revenue.

Google has expanded its financial services by forming a partnership with Citibank to enable its customers to open checking and savings accounts and plans to extend the partnership to ten additional banks and credit unions in the United States. Citi Plex, a service co-branded by Google and Citibank, offers checking and savings accounts with no monthly fees, overdraft fees, or minimum balance requirements. Similarly, Apple and Goldman Sachs created an iPhone-integrated credit card. Amazon uses data to approve small loans for merchants, customers, and small and medium-sized businesses.

Even while the relationship between Fintech companies and banks has grown recently, it still falls short of financial institutions. Only 28% have experienced an increase in loan volume of at least 5%. Only 14 percent of businesses have realized a revenue increase of at least 5 percent due to working with new product manufacturers.

How will Fintech and TechFin impact the future of the financial and economy?

Digitization of financial products and asset classes

All financial products and asset classes, whether utilized by retail clients, small and medium-sized companies (SMEs), or large institutions, will be digitized. The original wave of digitization included traditional products and services, including equities and government bonds, as well as consumer banking products like payments, loans, brokerage services, and vehicle insurance.

The second phase of digitizing consumer banking, SME and commercial banking, financial services, capital market, mortgage market, and fund management will be led by fintech. Mobile applications will facilitate the implementation of digitization projects across all corporate sectors.

A successful Fintech app development involves business domain knowledge and mobile application development experience. It is advantageous for a fintech or financial services organization to outsource app development to an accomplished mobile app development firm.

Embedded Financial Services Within The Software And Marketplace Solutions

Incorporating financial services improves the main product and service offerings while greatly expanding the platform companies’ addressable market in many industry categories. Embedded financial services will continue to be adopted by many organizations, including those that are not platform leaders.

Financial services are embedded in the following company categories:

- First, to integrate payments and lending to complement their core services and generate additional revenue options were marketplace ecosystems. This category comprises B2C marketplaces, e-commerce enablement systems, and B2B marketplaces with a vertical focus. This category includes Amazon, Shopify, and other businesses.

- Vertical software suppliers, such as content management systems, point-of-sale systems, and hospital management systems, are integrating payments into broader software packages that have traditionally emphasized business operations and consumer interactions.

- Flywire is a software suite packed with features that serve the education, tourism, and healthcare industries. These have unique payment requirements that cannot be met by the horizontal platforms. Flywire enables educational institutions to accept payments from international and domestic students via numerous payment options. Similarly, Flywire incorporates specialized financial services into its larger software portfolio for the healthcare and travel industries. The embedded financial services provide clients with a superior return on investment (ROI) than payment systems and banks.

- B2B “workflow systems” that automate accounts payable/accounts receivable, procurement, travel & expenses, and treasury administration. Using native payment solutions enables customers with smooth execution and back-end reconciliation, hence expediting the transition of B2B industry segments to digital payments. The embedded financial services enable software suppliers to provide consumers with integrated services and a portion of the bank’s profit pools.

As firms evaluate the ecosystem business model based on its value-generating potential, the ability to develop Fintech applications will be crucial to the strategy’s success. As organizations have attempted to imitate the ecosystem success of digital giants such as Google and Amazon, they have failed to recognize the value. Companies must concentrate on their core competencies by defining their ecosystem strategies and outsourcing app development to mobile app development specialists. These businesses have extensive technical knowledge and skill in application development processes, performance, and quality tools.

Digital payments innovation and Evolution

McKinsey predicts that worldwide payments will amount to $2.5 trillion by 2025. The vast possibility in payments makes it an ideal business category for Fintech and TechFin to target for innovation and disruption. We examine the ascent of three online payment pioneers who have paved the way for widespread digital disruption in the banking and financial services business.

PayPal

The first fintech company to have a substantial impact on the payments sector and signal the digital disruption of the banking and financial services industry. The customer-focused business streamlined the online payment process for e-commerce sites such as eBay, which previously relied on checks and laborious credit card transactions.

After establishing itself as the premier provider of e-commerce payment solutions, PayPal offered business accounts in 2000, allowing firms to accept an unlimited number of credit card payments. It pioneered international payments and money transfers and remained one of the most prominent Internet payment providers.

Square

After a decade of PayPal, the company pioneered a technological advancement in point-of-sale systems that enables small and medium-sized enterprises (SMEs) with low transaction volumes to accept credit card payments via a mobile phone-enabled card reader.

Square expanded into SME loans (Square Capital), rewards (Square loyalty), payroll services (Square Payroll), and other ancillary services after collecting merchant data.

Stripe

In 2010, when payments were a young business, the company began with a basic product of e-commerce payment processing. Since its inception a decade ago, Stripe has expanded its platform to include a wide range of product and service offerings across the full payments stack. Stripe has exploited innovation, smart commercial relationships, acquisitions, and new company investments.

Stripe has formed partnerships with Barclays, Citibank, and Goldman Sachs to provide banking-as-a-service for businesses. It has partnered with Afterpay to incorporate buy-now, pay-later checkout into its online payment services. Additionally, Stripe provides ancillary services, such as Stripe Atlas, that expedite the incorporation of firms in the United States.

As a result of its revolutionary product services, Stripe has experienced exponential growth, and it now collaborates with businesses across all industries, company sizes, and business models on a global scale.

The epidemic has expedited digitization, and Fintech and TechFin’s technological innovation will continue transforming the broader banking and services business. The next decade will usher in a new landscape for financial services, with digital becoming the major channel for firms and individuals.

Final Thoughts

Fintech tackles a particular financial service issue for clients by providing an innovative financial solution or process based on technological capabilities in the form of a new product or service. TechFins integrates different existing financial and technological solutions into its business model.

The increased value of data makes it attractive for large tech companies to profit from their collected data, and it has been very easy for them to be successful with the implementation of their products thus far due to their large customer base and the advantage they have with customers granting permission to use their data by agreeing to their terms and conditions (which are periodically updated in the benefit of the company). Moreover, when they become TechFins, they often experience no early fundraising concerns.

Initial funding is typically difficult to get for fintech businesses, which rely heavily on angel investors and banking institutions. Crowdfunding has proved advantageous for FinTech funding, although it still faces challenges and is not yet internationally accessible. The incorporation of crowdfunding as a financial/funding alternative remains an unsolved challenge for many authorities. And it may take some time to set common regulations for better administration of this FinTech solution.

Fintech and TechFin are both disruptive forces within the financial services business. If traditional institutions wish to survive the digital revolution, they must immediately digitize their corporate structures. We have seen that they frequently become consumers of Fintech and TechFin companies.

You may contact us if you wish to get your Fintech or TechFin Company designed.