The digital world of today has moved with speed, FinTech applications are about managing money, enhancing financial operations, and innovating in the financial sector. The FinTech apps brought a revolution in the way people and businesses deal with financial transactions, digital banking, investment apps, and even online payment gateways. This Ultimate Guide to FinTech App Development will take you through all that you should know about developing a successful FinTech application, from core principles to the most recent current industry trends.

Understanding FinTech App Development

FinTech applications are software solutions offering financial services and products over digital platforms. Such applications manage to make financial processes from very simple to complex to handle and utilize safely and effectively.

There’s a need to understand different aspects of developing a FinTech app: knowledge of compliance regulations, security of data, user experience, and integration with financial institutions. FinTech application development differs from general application development due to the separate challenges and opportunities of the financial sector.

Key Elements of FinTech Application Development:

Security and Compliance

Security of data and compliance with regulatory statutes will be of utmost importance. All financial applications must be developed in line with the highest industry standards, such as GDP-R, PCI-DSS, and all other regional financial regulatory requirements.

User-centered experience

Customer retention and engagement greatly depend on the seamless use of an application. An application should be intuitive, fast, and accessible.

Scalability

The app should be able to scale up with your users, wherein it would increase the volume of transactions and data generated without affecting the performance.

Read Also, Ultimate Guide to Property Management Software

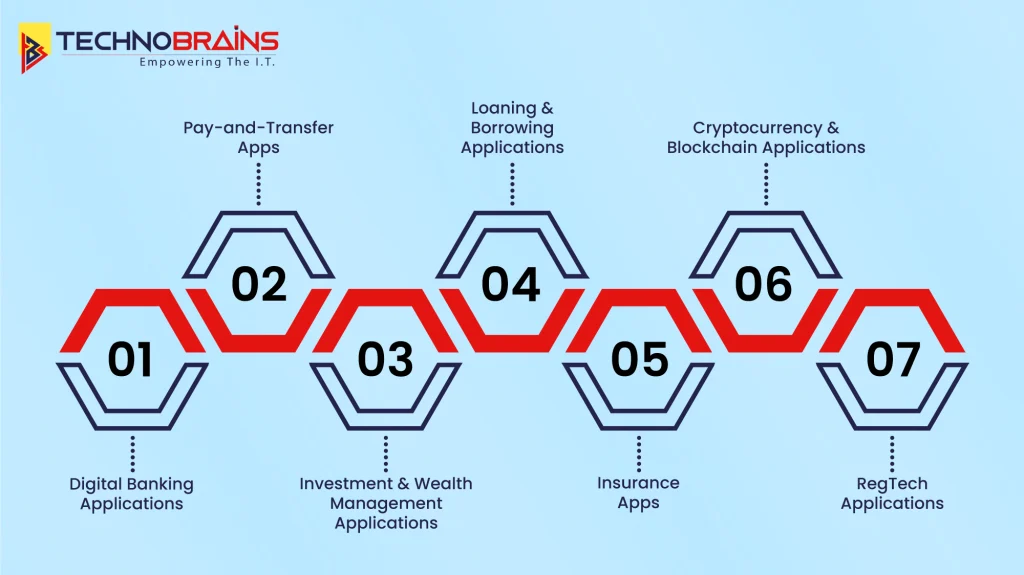

Exploring Different Types of FinTech Apps

A FinTech application is categorized for use, serving quite several purposes and meeting various needs of the users. Some of the most popular types of Fintech Applications are as follows:

1. Digital Banking Applications

These applications offer complete online services for banking, wherein one can operate bank accounts, perform transactions, and view all available financial products and services without actually having to go to any branch.

2. Pay-and-Transfer Apps

These peer-to-peer money transfer and payment applications enable the user to send and receive money in less than a few minutes. Some popular mobile wallets on this technology include but are not limited to, PayPal, Venmo, and Apple Pay, which have very successfully eased bill payments and money transfers all over the world.

3. Investment and Wealth Management Applications

With investment applications, users can invest in stocks and bonds. Wealth management applications help a user manage his or her investments, track his or her portfolios, and also plan future financial goals.

4. Loaning and Borrowing Applications

The apps connect the borrower with the lender, facilitating peer-to-peer lending and applications either for a loan or debt management. Many of them also use AI in reviewing creditworthiness and automating loan approval processes.

5. Insurance Apps

FinTech has also changed the face of the insurance sector. Various apps enable users to buy, manage, and claim insurance policies online; many of them use AI and big data for the betterment of personalized insurance solutions.

6. Cryptocurrency and Blockchain Applications

The demand for such applications, through which one can purchase, sell, or store cryptocurrencies, is growing with gradual popularity. Equally, decentralized transactions due to blockchain technology are also securely achieved.

7. RegTech Applications

Regulatory technology applications assist financial institutions in being more compliant with the set regulations through automation of reporting and monitoring of transactions to manage their risks.

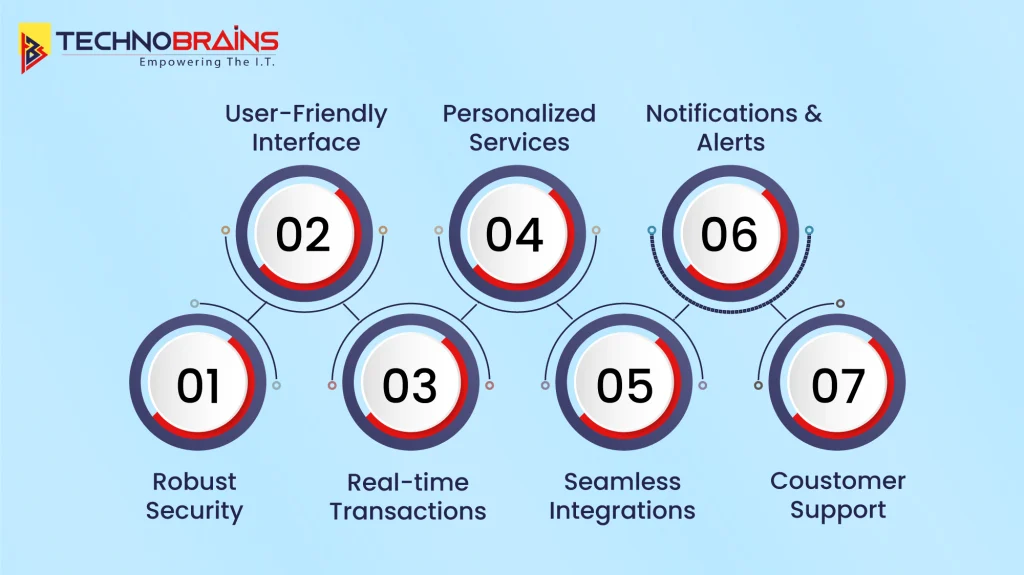

Top Features of Effective FinTech Apps

The following are the fintech app features that make up a successful FinTech application.

1. Robust Security

Security is of ultimate concern since financial data is sensitive. Consequently, this will relate to advanced security protocols that will comprise encryption, two-factor authentication, and biometric login.

2. User-Friendly Interface

A clear, intuitive design enhances the user experience. Another critical aspect is that FinTech applications need to simplify complex financial processes so that users of every technical level can handle them with ease.

3. Real-time Transactions

Instant processing of transactions, whether it’s a payment, transfer, or investment, is essential to meeting user expectations.

4. Personalized Services

AI-driven personalization, such as customized investment advice or spending analytics, keeps users active and enhances the user experience.

5. Seamless Integrations

Such FinTech applications should be integrated with other financial systems, such as banks or some other third-party services, allowing users to manage all of their finances within a single platform.

6. Notifications and Alerts

Real-time notifications about transactions, account activity, or updates help users stay informed and in control of their finances.

7. Customer Support

The ability to provide customer support through chatbots, live chat, or even call centers, if required, 24/7 is critical for solving issues quickly and keeping users satisfied.

Steps for Developing a Winning FinTech App

The creation of a FinTech application involves hard laid-out steps to ensure that the final product meets user expectations, and legal and regulatory requirements, and is secure. Below is a step-by-step guide to developing a successful FinTech app:

1. Concept Development and Market Research

It is very important to understand who the target audience is, what the competition is like, and how Top Fintech Trends shape the market. Research deep into user pain points and find unique value offered by your app.

2. Features and Functions Defined

It is very important to be clear about the top Essential Features of FinTech Apps. Based on the findings above, list down key features and functionalities your application should cover to add value. Make sure to include core features, such as transaction and security features, and differentiators like AI-driven insights.

3. UI/UX Design

Work with experienced designers who will help you, remembering that a user-friendly interface means an app layout that should be as simple as possible, intuitive, and seamless.

4. The Right Tech Stack

Therefore, it is very much essential to choose appropriate technology stacks in light of better performance, security, and scalability. Well-liked frameworks on which FinTech app development may happen include React Native, Flutter, and . NET.

5. Development of a Minimum Viable Product

An MVP is a good starting point, considering it gives you a chance to test the core functionality of your application with a limited number of features. This helps gather user feedback and make improvements before launching the full version.

6. Test and Secure the Application

Testing and Securing the Application make sure that the app functions smoothly as planned, while security audits catch and fix vulnerabilities.

7. Launch and Continuous Improvement

After going live, track performance metrics and user feedback to improve your app. Continuous enhancement and updates are important for competitive advantages and user engagement.

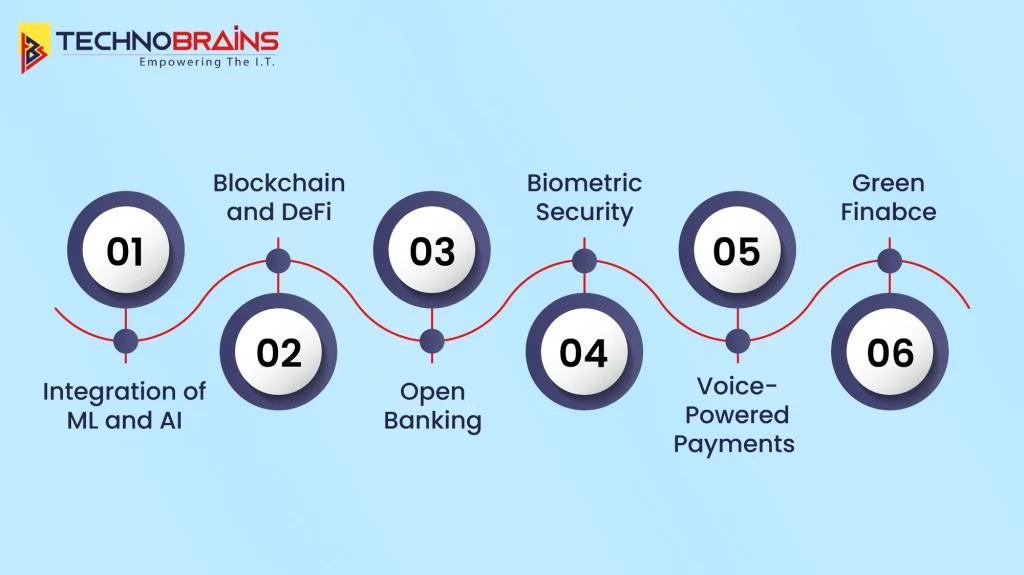

Latest Trends in FinTech App Development

Fintech surely is among the fastest-evolving industries, and without knowledge of all the latest trends, it is just impossible to create a competitive application that will be relevant. So here are the top FinTech app development trends to watch:

1. Integration of ML and AI

With the inclusion of advanced AI and ML-related strategies the applications that are being developed now come with a range of features that are super useful. Some of them include automating tasks such as customer support which is a major issue in fintech startups and businesses.

2. Blockchain and DeFi

It’s almost as if blockchain technology revolutionizes the level of security and transparency one experiences when performing any kind of financial transaction. Meanwhile, Decentralized Finance is making it a bit easier for users to access various financial services without intermediaries or banks.

3. Open Banking

Open banking enables customers to use third-party applications to share secure banking information. This opens new opportunities for more integrated and personalized financial solutions.

4. Biometric Security

There is an emergence of fingerprint-scanning-based and facial-recognition-based biometric authentication, tightening security in FinTech apps due to the rise in digital fraud.

5. Voice-Powered Payments

Voice technology has now been integrated into payment systems, given that users can make transactions or check balances through voice commands.

6. Green Finance

Green finance is a major talk these days and a range of applications are being developed for the same. These are used to track and reduce the carbon footprint which gives more insights into a wide variety of domains.

How Much Does It Cost to Develop a FinTech App?

When it comes to Fintech App Development Cost there are a range of variables here are some of them:

Complexness of the app

The more complex the app is, the more expensive it will be. Applications that have simple features such as allowing for the facilitation of payments and transfers will be relatively cheaper while those requiring AI, blockchain, or integrations with several financial institutions will cost more.

Technology Stack

The selection of the technology stack, along with third-party services being used, may be a factor regarding cost. Using a cloud-based service in your application will increase the cost.

Development Team

Hiring an experienced team or outsourcing to a reputable company will cost you money. For quality development, you need to invest in it.

Regulatory Compliance

Making your application comply with all the financial regulations is going to add time and costs to the project.

The cost to build a FinTech App differs in many cases. The price of development depends on various factors according to the requirements.

Why Choose TechnoBrains for FinTech Application Development?

Technobrains provides a good deal of experience in developing secure, scalable, and customized FinTech applications. Here is why you should choose us to develop your FinTech application:

FinTech Development Expertise

We develop secure, compliant, innovative FinTech solutions with extensive experience. Our team is aware of all the subtleties of financial application development to make sure the created application will meet all the industry standards.

Custom Solutions Maintained to Your Needs

We design customized FinTech applications that will suit your unique business models, be it digital banking, investment platforms, or payment gateways.

Security and Compliance

Our Fintech applications are built with the best-in-class security measures with sensitive financial data protection. We also make sure to keep all global and local regulations in full view.

End-to-End Development

TechnoBrains offers full-cycle development services for FinTech applications, from idea development to post-launch support, making your applications stay in tune with the trending cycles in the market.

Competitive Pricing

We offer very competitive pricing, but this does not mean we inevitably compromise on quality. Our flexible development plans ensure you get the best value for your investments.

Read Also, Why Choose TechnoBrains for Property Management Software?

Conclusion

Any development of a FinTech app would, therefore, be quite rewarding but at the same time a very challenging task. Once a full understanding of different types of FinTech apps, top features, and state-of-the-art trends is gained, then only one can come up with a successful app that meets the needs of users. Choose TechnoBrains for FinTech application development and we can help you with your requirements for FinTech solutions and keep you on top of the competitive finance arena.

Still stuck with questions? Contact Us today and get all your solutions here.