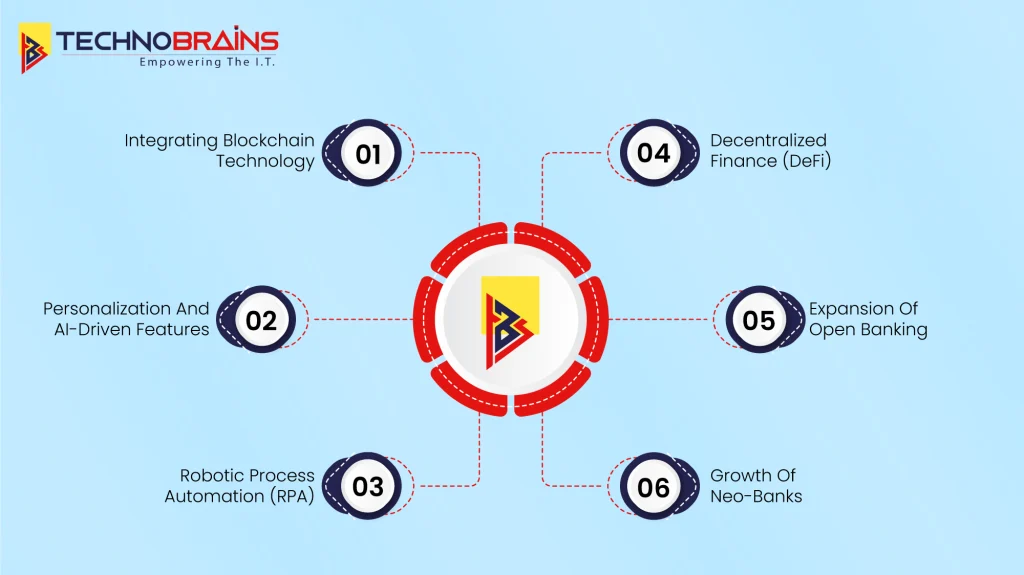

FinTech application development provides various solutions to improve financial services by making them more accessible, effective, and secure. This blog will look at the top FinTech trends that could shape the future.

1. Integrating Blockchain Technology

Blockchain technology has been game-changing for FinTech. Blockchain is incorporated into more FinTech applications to manage and handle payments, smart contracts, and data protection.

Security and Transparency:

Blockchain makes data storage and its transfer quite secure, reducing fraud since every transaction is traceable.

Cost-efficient Payments:

Blockchain allows for direct peer-to-peer transactions, which exclude intermediaries and make transaction fees lower.

Smart Contracts:

Self-executing contracts on the performance of predefined conditions, enhance efficiency and trust in agreements.

Read Also, Top 7 Essential Real Estate Tech Trends for Realtors

2. Personalization And AI-Driven Features

Personalization is the main focus of customer experience today, made possible more than ever by AI. Fintech applications nowadays use AI to offer customized financial solutions tailored to user behavior and preferences.

Custom Financial Advice:

AI systems study user data and enable personalized investment advice, savings plans, and budgeting techniques.

Improved Customer Service:

AI-powered chatbots and virtual assistants are proving to be responsive in responding to customers’ inquiries into their finances, hence making the delivery of services even quicker.

Fraud Detection:

AI algorithms can show abnormalities in user activity or some unusual transactions and hence are used to alert the user in the instance.

3. Robotic Process Automation (RPA)

Robotics is the future, be it any domain either construction or IT and that is why RPA is considered one of the most innovative Fintech App Development Trends that helps streamline a range of processes.

Data Entry Automation:

The RPA tools do all those repetitive tasks that involve data entry and its processing, hence freeing time for the employees to concentrate on more complicated tasks.

Faster Transactions:

With RPA, processes such as loan processing can become quicker, allowing them to keep the services they are giving their customers even faster.

Error Reduction:

Since RPA does all the work, thereby reducing manual work, this can reduce the possibility of errors.

4. Decentralized Finance (DeFi)

Among the most emerging trends in fintech app development the highest popularized is DeFi, then it has to be DeFi. With the help of DeFi, the users can easily and directly transact with each other in the absence of a centralized system.

Peer-to-Peer Transactions:

Activities of lending and borrowing among peers can be facilitated on a P2P basis with the facilitation of open, probabilistically transparent, efficient DeFi platforms.

More Accessibility:

DeFi opens up finance possibilities to the underserved people of the world, thus affording more people access to the global economy.

More Inclusion:

DeFi makes financial services more accessible to people in the most underserved regions, thereby affording more people an opportunity to participate in the global economy.

5. Expansion Of Open Banking

Another major trend in FinTech is Open Banking, which ensures that the consumer’s banking information is duly made available to Third-Party Providers with due consent. It opens up new vistas of competition and innovation in the financial services space. To know more about this you can go through the ultimate guide to FinTech app development.

Better Financial Management:

The ability of Open Banking to facilitate applications in pulling data from various sources is that people can monitor and manage their finances from one place.

Personalized Solution:

Having accessed the user’s data, FinTech applications can elaborate on more tailored financial solutions that will fully meet the individual’s spending habits and financial objectives.

Innovation Will be Fostered:

Open Banking nurtures effective competition, allowing more third-party providers to enter the market. This increased competition will result in more innovative financial products being developed.

6. Growth Of Neo-Banks

Neo-banks are only gaining popularity because they can offer purely digital services; no brick-and-mortar branches. Neo-banks will be famous for their intuitiveness, lower fees, and speedier services.

No Physical Branches:

Neo-banks operate with no physical branches. This ensures a reduction of overhead costs and, therefore, lower fees for customers coupled with superior rates.

Fast and Easy Access:

Neo-banks guarantee webs of fast opening of an account or loan and involve less paperwork without the inclusion of personal presence.

Advanced Features:

Some of such features include neo-banks, immediate-spend notifications, real-time tracking of payments, and many more that give insights into how one can manage their finances better.

Read Also, Latest Healthcare Trends to Follow in 2024

Conclusion

With trends such as blockchain, AI-driven personalization, and DeFi, the future is no doubt bright when it comes to FinTech app development. That not only brought force factors for efficiency but rather accessibility to financial services in the mainstream. Every business involved in the FinTech space needs to keep themselves updated with the trends to stay competitive and continue offering value to their customers. You can consider TechnoBrains for effective FinTech app development services.

Still stuck with questions? Contact Us today and get all your solutions here.