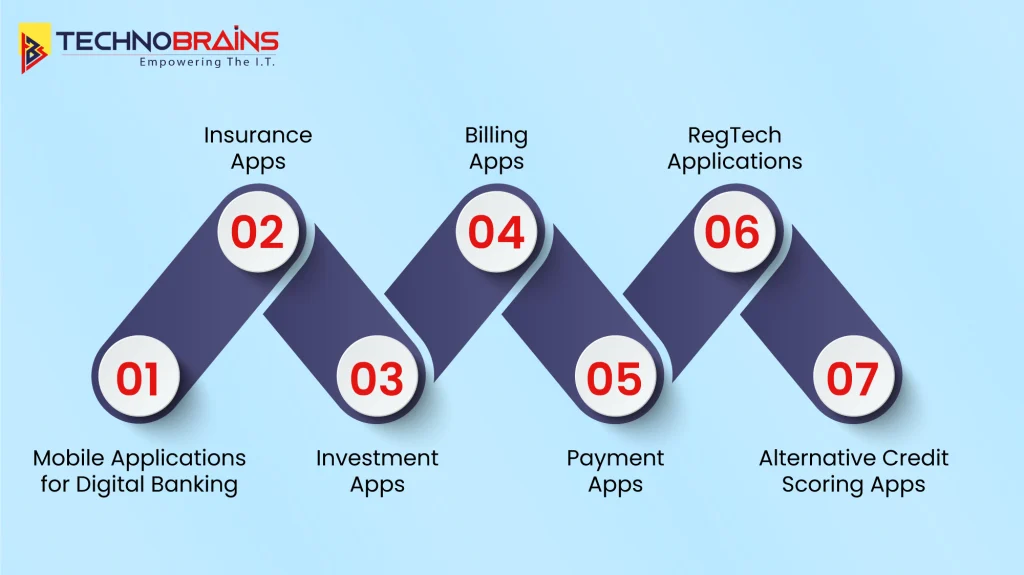

FinTech, which is widely known as Financial Technology, apps are quite changing the way people handle money and requirements for finance. These applications offer rapid, effective, and easy solutions to perform banking, investment, and payment-related tasks. In this blog, we will discuss other variations of FinTech apps that change the face of the financial world and how they assist individuals and enterprises. Let’s dive into the most popular different types of fintech App.

1. Mobile Applications for Digital Banking

The digital banking applications enable users to effect all sorts of banking activities using either their smartphones or computers. In essence, one needs not to be physically present at a bank, for with only a few clicks, one will be in a position to view the balance, transfer funds, and even pay bills.

Key Features:

- Easy access to account details

- Instant money transfers

- Bill payments, mobile recharges

- Automated savings and budgeting

Benefits:

- Convenience: Bank anywhere at any time.

- No long queues and no paperwork.

- Real-time transaction notifications.

2. Insurance Apps

This is one of the most popular types of fintech applications. Insurance FinTech applications ease the purchase and management of insurance policies. It allows users to compare various insurance plans, get instant quotations, and buy policies in the absence of agents. Further, it facilitates the review of coverage, filing claims, and renewing policies on a single platform with much ease.

Key Features:

- Policy comparisons

- Instant quotations

- Claims filing

- Easy renewals

Benefits:

- Smooth and quicker purchase process of insurance.

- Better comprehension of various plans.

- Transparency in price and coverage.

Read Also, Cost to Build Property Management Software

3. Investment Apps

Applications of FinTech in investment enable customers to invest in stocks, bonds, and even cryptocurrencies. Finally, such applications make things easy for first-timers as well as experienced investors. The user is allowed to track his portfolio, gain insight into market directions, and directly trade in real-time without the involvement of any broker.

Key Features:

- Easy investing tracking

- Real-time market updates

- Low-cost trading options

- Learning tools for beginners

Benefits:

- Accessible investment opportunities for all.

- Lower commissions than from traditional brokers.

- Investment advice through AI-driven personalized platforms.

4. Billing Apps

FinTech applications for billing and invoicing make it quite easy to handle invoices and their payments both for businesses and people. They automate the whole mechanism right from creating bills and invoices and sending them out to tracking the payments. To know what’s going around the world you can go through the latest trends in FinTech app development.

Key Features:

- Invoice generation

- Automated reminders for due payments

- Secure and fast payment options

- Payment tracking

Benefits:

- Eliminate manual paperwork and delays.

- Pays on time, with automated reminders.

- Simplifies record-keeping and tracking payments.

5. Payment Apps

Payment applications are designed to help make comfortable and fast transfers between individuals or organizations. With such apps, one can pay in several seconds without the use of cash or plastic cards. All you need is your smartphone and an app with which you want to pay for groceries, your meal, or just to split the bills with your friends.

Key Features:

- Instant money transfers

- Secure payment gateways

- QR code payment scanning

- Integration with bank accounts and digital wallets

Benefits:

- Cashless convenience for everyday transactions.

- Instant cross-border payments.

- Convenience and increased security compared to carrying cash.

6. RegTech Applications

Regulatory technology applications are created to support enterprises in observing complex sets of financial regulations. These applications monitor transactions that flag suspicious activity to make sure the business is abiding by the set rules. RegTech applications are particularly useful for businesses dealing in large volumes of transactions or sensitive financial data.

Key Features:

- Real-time transaction monitoring

- Fraud detection

- Compliance reporting tools

- Automated audit trails

Benefits:

- Reduces the risk of being fined for non-compliance.

- Keeps businesses updated about the latest regulations.

- Streamlines regulatory processes, conserving much time and resources.

7. Alternative Credit Scoring Apps

Alternative credit scoring apps use newer ways to decide the creditworthiness of an individual. While these traditional credit-scoring models bank on credit history and income, for instance, alternative credit-scoring apps consider more data from you, such as utility bill payments, your rent history, and even social media behavior. This opens up access to credit for those who may not have a traditional credit score.

Key Features:

- Use of non-traditional data for credit assessment

- Real-time updating of credit scores

- Customized Loan Recommendations

- Transparent process of calculating the credit score

Benefits:

- Access to credit for those individuals who do not have any traditional credit history.

- More equitable assessments based on behavior and regular payments.

- Helps an individual build credit over time.

Read Also, Comprehensive Guide to Developing FinTech Applications

Conclusion

With FinTech applications, the financial service will be more approachable, affordable, and time-saving for everyone. One of the reasons such apps are on the rise is because they have helped both individuals and business enterprises smooth their financial activities and made the management of money quite easy, something that was never experienced earlier. If you are looking for a Fintech app development company then consider TechnoBrains for effective results.

Still stuck with questions? Contact Us today and get all your solutions here.