Everything from simple banking to managing investments is handled through FinTech financial applications. A FinTech application will receive people’s attention only if the app is sufficiently user-friendly and provides ease in finance management. This blog presents the essential Fintech app features.

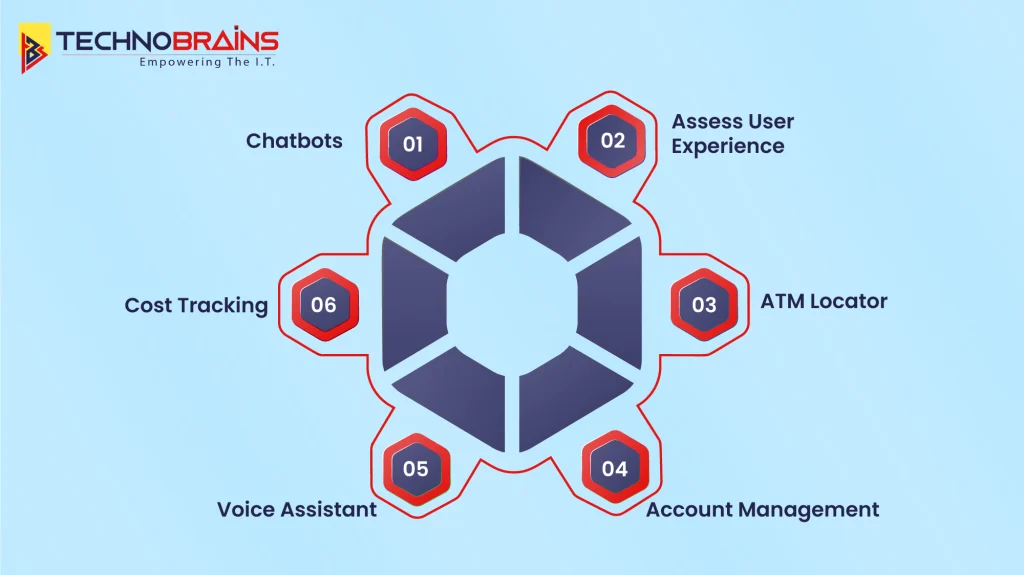

Core Features for Building a Powerful Fintech App

Get to know what makes a FinTech application powerful. These elements act as a base of growth and some of the prominent features among them are listed below:

1. Chatbots: 24 × 7 Customer Support

This AI engagement can support its users in real-time and answer questions or solve problems anytime of the day or night. This feature is essential to customer satisfaction because users can immediately get help without waiting for a human representative.

Why Chatbots Matter:

- Available 24/7 to assist users.

- Immediate response to simple questions.

- Helps reduce waiting times for those whose need for the service is urgent.

- Offers personalized responses, hence improving the overall customer service experience.

2. Assess User Experience: Easy to Navigate, User-Friendly Design

If there is navigational difficulty in moving around the app or understanding its features, users will leave. The testing of user experience involves ensuring that the app is not difficult to use by any user, including those unsavvy with technology.

Key Aspects of Good User Experience:

- Simple and intuitive design.

- Easy navigation with clearly marked buttons and menus.

- Quick access to all major features.

- Minimum loading times, so no frustration.

Read Also, Comprehensive Guide to Developing FinTech Applications

3. ATM Locator: Find Your Nearest Cash Machine with Ease

This is one of the top 6 essential features of FinTech apps which is a very useful feature for FinTech app users. Many users depend on ATMs either for cash withdrawals or deposits, and quite often, the location of the nearest one has been a real irritant.

Benefits of an ATM Locator:

- Displays nearby ATMs according to the user’s location.

- Provides information on ATM fees, if applicable.

- Can indicate if the ATM is out of order or in service.

- The feature would greatly help customers access cash quickly and also without hassle, which therefore is a valuable convenience for many customers.

4. Account Management: Take Control of Your Finances Anywhere

Whenever it comes to anything related to FinTech, account management is at the very core. It should offer users the possibility of logging into bank accounts, checking their balances, performing transfers, and paying bills right from their mobile device screens.

Account Management Features

- Check account balances and transaction history.

- Transfer funds within accounts or to other people.

- Pay bills directly through the app.

- Set up automatic deductions to pay repeated bills.

5. Voice Assistant: Hands-Free Financial Management

Voice assistants are increasingly being integrated into applications in the FinTech space. There are different types of FinTech app in which this feature will help to check balance, transfer money, or pay bills by verbose voice without typing or clicking on the app.

Advantages of Virtual Voice Assistants:

- Provides hands-free experience for multitasking users.

- Saves time with fast response to voice commands.

- Improves accessibility for people with disabilities.

- Reduces the need for manual navigation within the app.

6. Cost Tracking: Keep an Eye on What You Spend

Expense tracking is one of the features most wanted in FinTech applications. It enables users to track their expenditures by categorizing their costs and, therefore, provides an overview of spending. Cost tracking takes over control of the user’s finances in such a way that it makes it very easy to budget and save, even for times well into the future.

Why Cost Tracking is so Important:

- Automatically classifies expenses, entertainment, and bills.

- Provides reports on spending to make budgeting more effective.

- It gives alerts to users when spending goes past a certain limit.

- Helps users save money by finding unnecessary expenses.

Read Also, Latest Trends in FinTech App Development

Conclusion

The future of FinTech applications is going to be enabled by simple, efficient, and user-friendly features that will enrich customer experiences. From chatbots that offer instant support, to voice assistants and cost tracking that help people stay atop their finances, all add up and make a huge difference to customer satisfaction. Are you looking for the best FinTech application development services? Then contact TechnoBrains.

Still stuck with questions? Contact Us today and get all your solutions here.