Get 40 Hours Free Developer Trial

Test Our Developers for 40 Hours at No Cost - Start Your Free Trial →

Integrating PayPal to your ecommerce store gives your business reach in 200 countries and makes it possible to accept payments in 25 different currencies. PayPal has millions of active users worldwide, so including their payment service can increase trust in your business and create chances to grow your sales. It also allows businesses to receive payments faster since it cuts down the time needed for transaction processing, with instant payment options available through cards.

Business owners often like that customers can make payments using PayPal without sharing sensitive banking information. As an expert ecommerce development services provider, we guide our clients on how to add PayPal to their website while maintaining security and optimizing the checkout experience.

In this guide, we’ll explain everything you need to know about integrating PayPal into your website, from creating a business account to testing your implementation before going live.

Why Choose PayPal for a Payment Gateway?

Choosing a payment gateway for your website can be tricky, but PayPal standout at the top in global payment processing. As PayPal supports transactions in multiple currencies worldwide, it instantly gives your store international reach without complex currency conversions.

Businesses see higher sales potential because 54% of customers are more likely to purchase when PayPal is an option. Offering PayPal can also boost checkout conversion rates by 44%, which is much better than other payment options.

Security remains a top priority for online shoppers. PayPal API integration provides robust protection through:

- End-to-end encryption and 24/7 transaction monitoring that keeps your business PCI compliant.

- Advanced fraud detection systems that protect both you and your customers.

- Seller Protection programs that shield you from fraudulent transactions and unauthorised claims.

Another reason is that the cost structure is notably business-friendly as well. There are no setup, monthly, or gateway fees like traditional processors, just a transaction fee of 2.9% plus a small fixed fee based on currency.

Consequently, integrating PayPal into your website delivers both practical benefits and customer confidence. The platform’s widespread recognition means your business gains credibility simply by displaying the PayPal logo at checkout—a powerful advantage, particularly valuable for smaller or newer online stores.

Common Challenges Business Owners Face When Setting Up PayPal

Despite the many benefits of PayPal integration, implementing this payment gateway isn’t always smooth sailing.

Transaction declines represent a significant challenge for online businesses. According to research, many organisations report that their customers frequently experience at least one transaction being declined. These declines happen for various reasons—insufficient funds, configuration errors, expired cards, or overzealous fraud detection systems flagging legitimate purchases.

Technical hurdles frequently arise during the PayPal API integration process:

- White spaces accidentally included when copying API credentials can cause integration failures

- Content Security Policy (CSP) conflicts between PayPal and your website

- Currency conversion settings are not properly configured in your PayPal dashboard

Many businesses struggle with the unexpected account limitations PayPal sometimes imposes. These restrictions can freeze funds without warning due to suspected unauthorized use, sudden sales volume changes, or high chargeback rates. Such limitations severely impact cash flow and operations.

The customer experience remains paramount throughout the PayPal integration process. Research shows 59% of organisations report customers abandoning shopping carts when their preferred payment method isn’t available. Moreover, how to add PayPal to my website becomes complicated when trying to maintain a seamless checkout experience across all devices.

Read Also, How Much Does an eCommerce Website Development Cost?

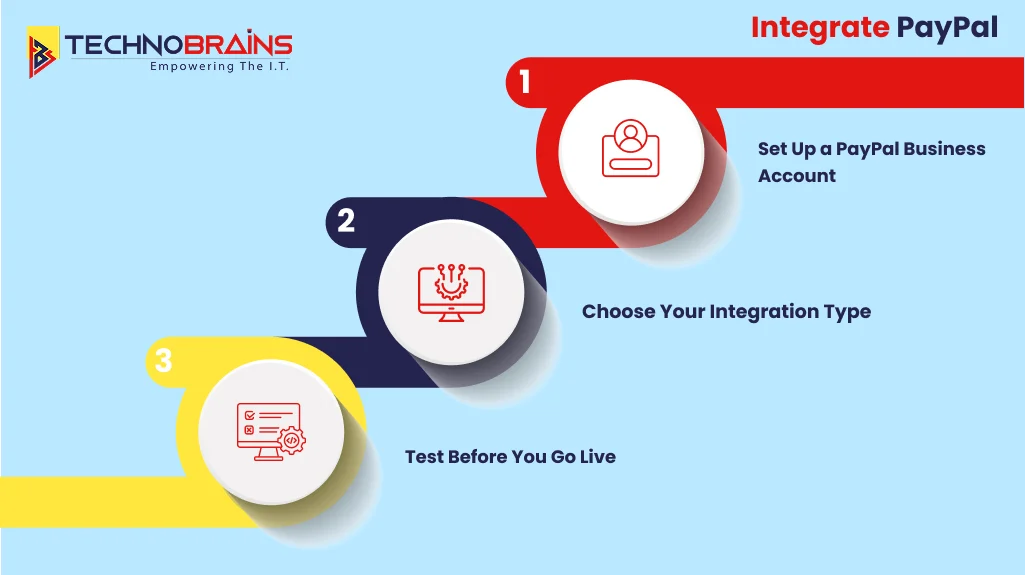

How to Integrate PayPal into Your Website

Implementing PayPal integration is a systematic process that we at Technobrains have refined through years of experience with ecommerce development. As PayPal experts, we’ve distilled the integration process into straightforward steps that work across various website platforms.

Step 1: Set Up a PayPal Business Account

Initially, you’ll need to create a dedicated business account on PayPal’s website. During setup, you’ll provide:

- An email address for your business

- Account identification information

- Website URL

- Personal details (name, telephone, address)

- Banking information where payments will be deposited

Step 2: Choose Your Integration Type

Once your account is active, PayPal offers three primary integration options depending on your technical capabilities:

- HTML Buttons – Perfect for smaller businesses with limited technical knowledge. Simply log into PayPal, create customised payment buttons, and then copy/paste the HTML code directly onto your website.

- eCommerce Platform Integration – If you use platforms like Shopify or WooCommerce, navigate to your admin portal’s payment settings, select PayPal Standard, and enter your PayPal business credentials.

- API Integration – For custom checkout experiences, our developers at Technobrains implement PayPal’s JavaScript SDK and REST APIs for a fully tailored solution.

Step 3: Test Before You Go Live

Consequently, thorough testing is critical before launching your PayPal website integration. We always recommend:

- Creating sandbox test accounts through the PayPal Developer Dashboard

- Testing both PayPal payments and credit card transactions

- Verifying correct payment amounts appear in your test account

- Confirming that the checkout process works across different devices

- Testing error scenarios to ensure proper handling

Furthermore, ensure you check that order notifications arrive correctly and that customers are properly redirected after completing payment.

When Should You Hire a PayPal Integration Expert?

While DIY PayPal integration is possible, certain situations make professional assistance essential. At Technobrains Business Solutions, we’ve seen firsthand that businesses often reach critical points where expert guidance becomes invaluable.

Consider getting expert help when:

- Your team lacks the skills to handle advanced technical challenges. The PayPal API can be tough to figure out if you are not familiar with payment systems. What seems like a simple implementation often involves security protocols and complex data management that requires specialised knowledge.

- Starting a new eCommerce venture. When starting an online store, professional ecommerce PayPal implementation ensures your payment foundation is solid from day one, preventing costly rework later.

- Security and compliance concerns arise. Payment processing demands strict adherence to PCI DSS and other security standards. Experts ensure your PayPal website integration meets all regulatory requirements while protecting sensitive customer data.

- Custom payment workflows are needed. Standard integrations sometimes fall short for businesses with unique requirements. Our developers at Technobrains create tailored solutions that align perfectly with specific business processes.

- System compatibility issues emerge. Ensuring compatibility between your existing systems and PayPal’s API can be problematic, especially with legacy systems or after updates to either platform.

- Real-time synchronisation is critical. Professional implementation ensures consistent, up-to-date data synchronisation across both systems without latency issues.

Why Hire TechnoBrains for PayPal Integration?

Choosing the right integration partner makes all the difference when adding payment gateways to your website. As a well-known eCommerce development company, TechnoBrains approaches PayPal integration with data-driven methodologies that ensure robust implementation. Our development team analyses your specific requirements before creating a customer-centric eCommerce website engineered to increase revenue and boost ROI.

Technical Expertise

TechnoBrains excels at creating eCommerce solutions that maintain performance stability even under high traffic loads. This reliability is important for payment processing, where transaction failures directly impact your bottom line. Our years of experience ensure your PayPal integration works flawlessly during peak sales periods or sudden traffic spikes.

Moreover, our implementations include comprehensive documentation and hands-on training to empower your team with the knowledge needed to manage your online store effectively. This approach minimises dependency and ensures your staff can handle daily operations confidently.

Standard Integration

We do not just integrate PayPal, we optimize it too. Our solutions incorporate various seamless payment processing options that serve customers according to their preferences. This flexibility encourages more transactions and improves overall sales performance.

Notably, TechnoBrains integrates advanced analytics and reporting tools that provide valuable insights into customer behaviour and sales patterns. These tools help you understand transaction trends and make informed business decisions based on actual payment data.

Ongoing Support and Security

Most importantly, TechnoBrains Business Solutions provides continuous support through regular updates and maintenance. This ongoing relationship ensures your eCommerce site remains updated with the latest PayPal features and security protocols, maintaining optimal performance and protection.

Conclusion

The above guide explained, why integrating PayPal into your eCommerce site makes sense. PayPal integration offers many benefits, from global reach to strengthened security, increased conversion rates, and accelerated cash flow. While there are some challenges, a proper setup solves issues like transaction problems, fraud protection, and handles technical obstacles.

Ultimately, PayPal integration represents more than just adding another payment option—it signals professionalism, builds trust, and removes barriers to purchase. The investment in proper implementation pays dividends through increased sales, expanded market reach, and enhanced customer satisfaction. Start your integration journey today, and watch your online business reach new heights of success.

Ready to boost your sales and simplify online payments? Contact TechnoBrains, and let our experts seamlessly integrate PayPal into your website!

FAQs: Integrate PayPal Into Your Website

PayPal integration allows your website to accept payments from PayPal and cards securely. It helps people trust, expands your business globally, and improves checkout conversion rates.

You can create a PayPal Business account through their website, providing your email, identification details, website URL, and banking information, and verifying your account.

Yes, PayPal provides sandbox account to check transactions and confirm payment notifications. This account also helps you ensure the checkout process performs well on various devices before launch.

Common issues you face like, transaction declines, API configuration errors, currency misconfigurations, content security conflicts, and unexpected account limitations that may temporarily freeze funds.

If your team lacks technical knowledge, needs custom payment workflows, requires PCI compliance, or wants seamless system compatibility and real-time data synchronization, it’s good time to hire an expert.

TechnoBrains provides expert integration with reliable, scalable solutions, custom workflows, analytics, and ongoing support while ensuring security and PCI compliance.